A) −$12,000

B) −$62,000

C) $12,000

D) $164,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

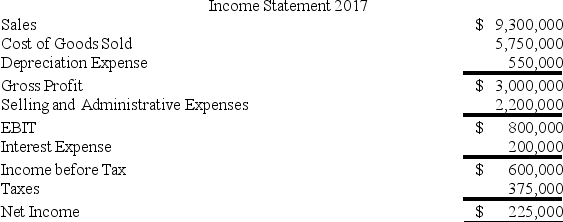

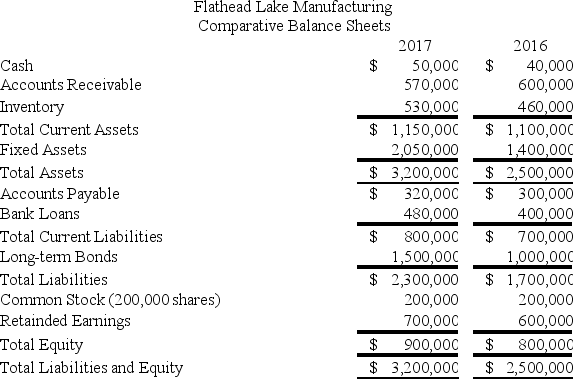

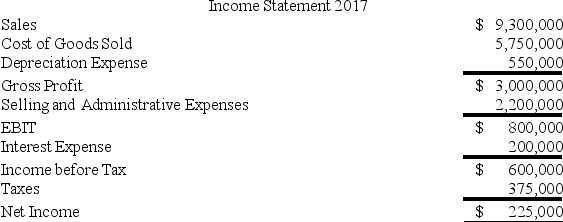

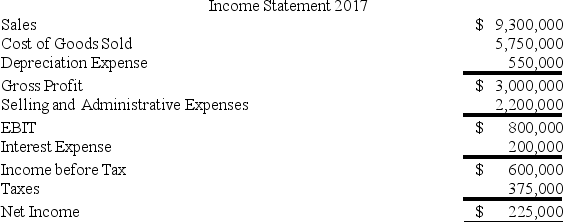

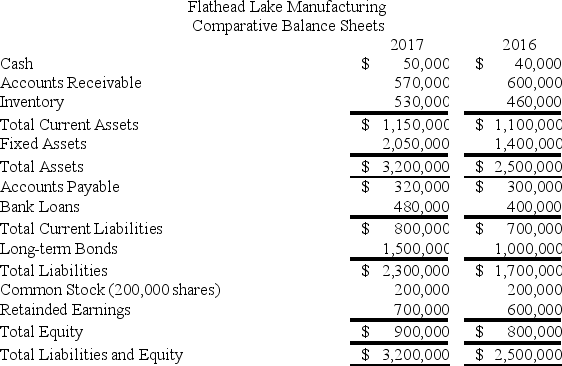

The financial statements of Flathead Lake Manufacturing Company are shown below.

Note: The common shares are trading in the stock market for $15 per share.

Refer to the financial statements of Flathead Lake Manufacturing Company. In 2017 Flathead generated ________ of EBIT for every dollar of sales.

Note: The common shares are trading in the stock market for $15 per share.

Refer to the financial statements of Flathead Lake Manufacturing Company. In 2017 Flathead generated ________ of EBIT for every dollar of sales.

A) $0.075

B) $0.086

C) $0.092

D) $0.099

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following transactions will result in a decrease in cash flow from investments?

A) acquisition of another business

B) capital gain from sale of a subsidiary

C) decrease in net investments

D) sale of equipment

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

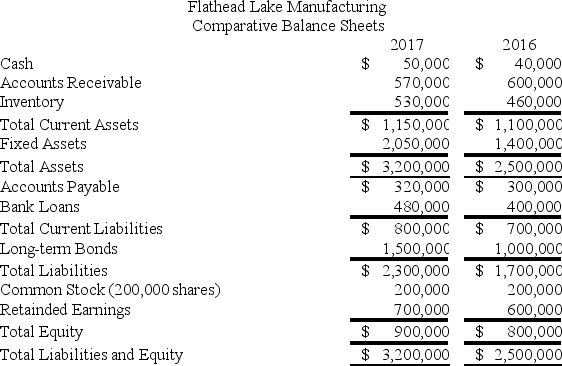

The financial statements of Flathead Lake Manufacturing Company are shown below.

Note: The common shares are trading in the stock market for $15 per share.

Refer to the financial statements of Flathead Lake Manufacturing Company. The firm's cash flow from operating activities for 2017 was ________.

Note: The common shares are trading in the stock market for $15 per share.

Refer to the financial statements of Flathead Lake Manufacturing Company. The firm's cash flow from operating activities for 2017 was ________.

A) $810,000

B) $775,000

C) $755,000

D) $735,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm's leverage ratio is 1.2, interest-burden ratio is 0.81, and profit margin is 0.25, and its asset turnover is 1.1. What is the firm's compound leverage factor?

A) 0.243

B) 0.267

C) 0.826

D) 0.972

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial statements of Flathead Lake Manufacturing Company are shown below.

Note: The common shares are trading in the stock market for $15 per share.

Refer to the financial statements of Flathead Lake Manufacturing Company. The industry average ACP is 32 days. How is Flathead doing in its collections relative to the industry? (Please keep in mind that when a ratio involves both income statement and balance sheet numbers, the balance sheet numbers for the beginning and end of the year must be averaged.)

Note: The common shares are trading in the stock market for $15 per share.

Refer to the financial statements of Flathead Lake Manufacturing Company. The industry average ACP is 32 days. How is Flathead doing in its collections relative to the industry? (Please keep in mind that when a ratio involves both income statement and balance sheet numbers, the balance sheet numbers for the beginning and end of the year must be averaged.)

A) Flathead's receivables are outstanding about 9 fewer days than the industry average.

B) Flathead's receivables are outstanding about 15 fewer days than the industry average.

C) Flathead's receivables are outstanding about 12 more days than the industry average.

D) Flathead's receivables are outstanding about 6 more days than the industry average.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cost of goods sold refers to ________.

A) direct costs attributable to producing the product sold by the firm

B) salaries, advertising, and selling expenses

C) payments to the firm's creditors

D) payments to federal and local governments

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many observers believe that firms "manage" their income statements to ________.

A) minimize taxes over time

B) maximize expenditures

C) smooth their earnings over time

D) generate level sales

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 88 of 88

Related Exams