A) 119.25

B) 121.25

C) 151.25

D) 95.25

E) 100.25

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The Standard & Poor's International Index consists of three international, 19 national, and 38 international industry indexes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Index movements are influenced by differential prices of the components in a(n)

A) equally-weighted index.

B) price-weighted index.

C) unweighted index.

D) value-weighted index.

E) over-weighted index.

G) D) and E)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

-Refer to Exhibit 4.2. Calculate a value weighted index for Jan. 13th if the initial index value is 100.

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

-Refer to Exhibit 4.2. Calculate a value weighted index for Jan. 13th if the initial index value is 100.

A) 111.54

B) 100

C) 102.31

D) 123.07

E) 143.25

G) C) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

An example of a value weighted stock market indicator series is the

A) Dow Jones Industrial Average.

B) Nikkei Dow Jones Average.

C) S & P 500 Index.

D) Value Line Index.

E) Shearson Lehman Hutton Index.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

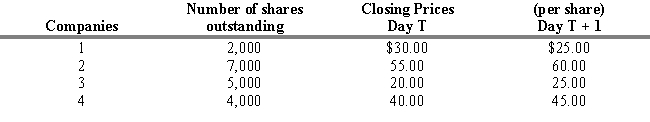

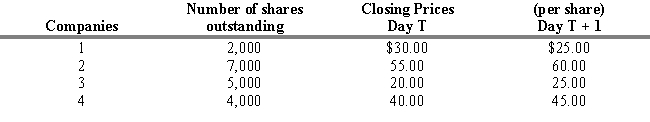

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 4.1. Assume that a stock price-weighted indicator consisted of the four issues with their prices. What are the values of the stock indicator for Day T and T + 1, and what is the percentage change?

-Refer to Exhibit 4.1. Assume that a stock price-weighted indicator consisted of the four issues with their prices. What are the values of the stock indicator for Day T and T + 1, and what is the percentage change?

A) 36.25, 38.75, 6.9 percent

B) 38.75, 36.25, -6.9 percent

C) 100, 106.9, 6.9 percent

D) 107.48, 106.33, 1.15 percent

E) 106.9, 100, 5.7 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 4.1. Compute an unweighted price indicator series, using geometric means. What is the percentage change in the index from Day T to Day T+1? Assume a base index value of 100 on Day T.

-Refer to Exhibit 4.1. Compute an unweighted price indicator series, using geometric means. What is the percentage change in the index from Day T to Day T+1? Assume a base index value of 100 on Day T.

A) 5.35 percent

B) 7.48 percent

C) 9.93 percent

D) 6.33 percent

E) 0 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exchange traded funds

A) are exactly the same as index mutual funds.

B) can be bought and sold like common stocks.

C) cannot be sold short.

D) have a high management fee.

E) cannot be timed for capital gain tax realizations.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

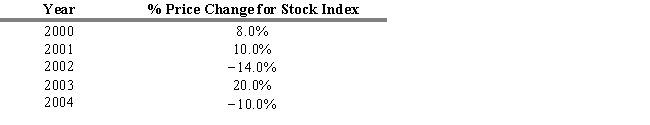

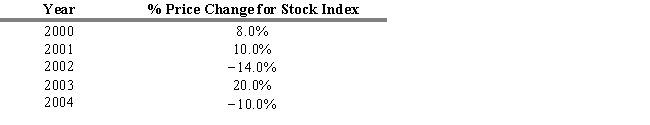

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 4.4. Calculate the average annual rate of change for this index for the five-year period using the arithmetic mean.

-Refer to Exhibit 4.4. Calculate the average annual rate of change for this index for the five-year period using the arithmetic mean.

A) 0.28%

B) 1.28%

C) 2.80%

D) 3.58%

E) 6.38%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 4.4. Calculate the average annual rate of change for this index for the five-year period using the geometric mean.

-Refer to Exhibit 4.4. Calculate the average annual rate of change for this index for the five-year period using the geometric mean.

A) 0.09%

B) 1.99%

C) 3.99%

D) 4.50%

E) 4.67%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

-Refer to Exhibit 4.5. Calculate the price weighted series for Dec 31, 2003, after the splits.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

-Refer to Exhibit 4.5. Calculate the price weighted series for Dec 31, 2003, after the splits.

A) 72.5

B) 100.0

C) 119.25

D) 121.25

E) 81.69

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Studies of correlations among monthly equity price index returns have found

A) low correlations between various U.S. equity indexes.

B) high correlations between various U.S. equity indexes.

C) high correlations between U.S. and non-U.S. equity indexes.

D) negative correlations between various U.S. equity indexes.

E) high correlations between equity and bond indexes.

G) All of the above

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

-Refer to Exhibit 4.2. Calculate a value weighted index for January 15th if the initial index value is 100.

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

-Refer to Exhibit 4.2. Calculate a value weighted index for January 15th if the initial index value is 100.

A) 102.31

B) 100

C) 123.07

D) 111.54

E) 121.32

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the fundamental factors was NOT used in the Fundamental Index created by Research Affiliates, Inc.?

A) sales

B) profits (cash flow)

C) leverage (debt/equity)

D) net assets (book value)

E) dividends

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A bond market index is easier to create than a stock market index because the universe of bonds is much broader than that of stocks.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A value weighted index automatically adjusts for stock splits.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is an example of a Style Index?

A) small-cap growth

B) mid-cap value

C) small-cap value

D) mid-cap growth

E) All of these are correct.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The major U.S. stock indexes are highly correlated.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

-Refer to Exhibit 4.5. Calculate the percentage return in the value weighted index for the period Dec 31, 2003 to Dec 31, 2004.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

-Refer to Exhibit 4.5. Calculate the percentage return in the value weighted index for the period Dec 31, 2003 to Dec 31, 2004.

A) 12.68 percent

B) 20.00 percent

C) 21.76 percent

D) 33.33 percent

E) 40.00 percent

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The Morgan Stanley group index for Europe, Australia, and the Far East (EAFE) is a price weighted index.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 89

Related Exams