B) False

Correct Answer

verified

Correct Answer

verified

True/False

Subprime mortgage-backed securities generally include FHA-insured or VA-guaranteed mortgages,along with conventional mortgages.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The main purpose of the Term Asset-Backed Securities Loan Facility (TALF) is to:

A) Buy mortgage backed securities owned by Freddie Mac,Fannie Mae,and Ginnie Mae

B) Issue CDOs and use the proceeds to fund infrastructure projects to stimulate the economy

C) Regulate hedge funds to reduce investments in risky assets

D) Use residential loans as collateral to purchase U.S.Treasuries as a way to reduce interest rates

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a premium is paid on a CMO issue (at the time of issue),yields will increase as prepayment rates accelerate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

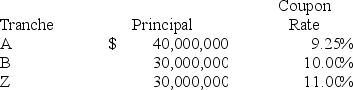

A mortgage company is issuing a CMO with three tranches,with the principal and coupon rate given in the table below.When issued,the weighted average coupon on the CMO will be:

A) 9.25%

B) 10.00%

C) 10.08%

D) 11.00%

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

CDOs often include "B" notes,mezzanine debt and preferred equity as investments.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In comparison to other mortgage-backed securities,the unique characteristic of CMOs is that:

A) CMO issuers do not retain ownership of the underlying mortgage pool

B) CMOs are issued in multiple security classes

C) The CMO mortgage pool is not overcollateralized

D) CMOs are a pay-through in which all amortization and prepayments flow through to investors

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows remaining after all CMO tranches have been paid off are referred to as REMICs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Investors retain prepayment risk on MBBs,but issuers incur this risk with MPTBs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The credit rating of an MPTB depends largely on the:

A) Amount of overcollateralization

B) Degree to which government-related securities constitute the excess collateral

C) Riskiness of the mortgage in the underlying pools

D) All of the above

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Class A investors are sometimes repaid with an accelerated pattern of cash flows and are sometimes referred to as:

A) Accelerated tranches

B) Quick pay tranches

C) Tranche residuals

D) Fast pay tranches

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A floater is a CMO tranche that has a variable interest rate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

CMO investors only pay taxes on interest income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding mortgage pass-through bonds (MPTBs) is FALSE?

A) MPTBs can be viewed as mortgage-backed bonds with the pass-through of principal and prepayment features of a mortgage pass-through security

B) Most MPTBs are based on residential mortgage pools and are generally overcollateralized

C) MPTBs represent an undivided equity ownership interest in a mortgage pool

D) All of the above are false.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The residual position in the CMO offering is considered which kind of position?

A) Primary

B) Equity

C) Interest

D) Debt

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT characteristic of commercial-backed mortgage securities?

A) The underlying mortgage pool represents a variety of different property types (retail,multifamily,etc.) and a specific geographical area

B) The underlying mortgages have usually been outstanding for several years

C) One of the primary issuers of such securities are insurance companies

D) In general,the underlying mortgage pool for such securities contain fewer mortgages than are included in residential-backed mortgage pools

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Duration is defined as:

A) A measure of the extent to which different investments expose an investor to interest rate risk

B) A measure of the weighted-average time required before all principal and interest is received on an investment

C) A measure that takes into account both the size of cash flows and the timing of their receipt

D) All of the above

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the primary distinction between mortgage-related securities backed by residential mortgages and those backed by commercial mortgages?

A) Default is the key risk with residential mortgages; prepayment is the key risk with commercial mortgages

B) Interest rate risk is the key risk with residential mortgages; prepayment is the key risk with commercial mortgages

C) Prepayment is the key risk with residential mortgages; default is the key risk with commercial mortgages

D) Prepayment is the key risk with residential mortgages; interest rate risk is the key risk with commercial mortgages

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a CMO security type?

A) A repeat floater

B) A Z tranche

C) An inverse floater

D) An IO tranche

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

From the issuer's perspective,the use of MBBs and MPTBs should be viewed as a method of debt financing.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 41

Related Exams