A) $244,000.

B) $238,000.

C) $267,750.

D) $241,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Job 123 requires $12,000 of direct materials,$5,500 of direct labor,500 direct labor hours,and 300 machine hours.It also requires 6 hours of inspection at $40 per hour.Manufacturing overhead is computed at $30 per direct labor hour used and $40 per machine hour used. The total amount charged for inspection

A) is $40.

B) is $40 × budgeted hours.

C) is $240.

D) does not figure into the total cost of the job.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Job 450 requires $9,800 of direct materials,$6,400 of direct labor,590 direct labor hours,and 400 machine hours.Manufacturing overhead is computed at $14 per direct labor hour used and $10 per machine hour used. The total cost of Job 450 is

A) $12,260.

B) $28,460.

C) $16,200.

D) $24,460.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

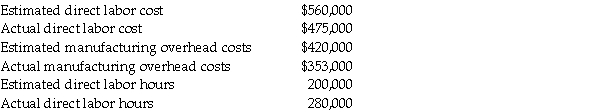

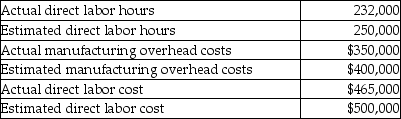

Oakland Company is debating the use of direct labor cost or direct labor hours as the cost allocation base for allocating manufacturing overhead.The following information is available for the most recent year:  Determine the following:

a)Predetermined manufacturing overhead rate using direct labor cost as the allocation base

b)Predetermined manufacturing overhead rate using direct labor hours as the allocation base

c)Allocated manufacturing overhead costs based on direct labor cost for the year

d)Allocated manufacturing overhead costs based on direct labor hours for the year

Determine the following:

a)Predetermined manufacturing overhead rate using direct labor cost as the allocation base

b)Predetermined manufacturing overhead rate using direct labor hours as the allocation base

c)Allocated manufacturing overhead costs based on direct labor cost for the year

d)Allocated manufacturing overhead costs based on direct labor hours for the year

Correct Answer

verified

Correct Answer

verified

True/False

An overallocation of manufacturing overhead is typically corrected by decreasing Cost of Goods Sold on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The Work-in-Process account is debited for the cost of direct labor in a job cost system.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

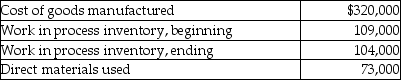

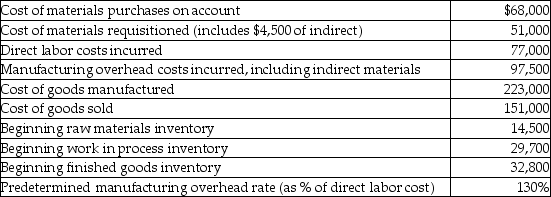

Here are selected data for Bailey Company:

Manufacturing overhead is allocated at 50% of direct labor cost.

What was the amount of direct labor costs?

Manufacturing overhead is allocated at 50% of direct labor cost.

What was the amount of direct labor costs?

A) $78,000

B) $161,333

C) $168,000

D) $242,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When is the adjusting of cost of goods sold for the underallocation or overallocation of manufacturing overhead generally done?

A) At the end of the period

B) During the period

C) Before the period starts

D) Never

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

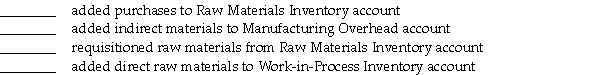

On the line in front of each statement,enter either a D for debit or a C for credit to indicate the normal entry that would be needed for each account named.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To record the costs of indirect labor,which of the following accounts would be debited?

A) Work-in-Process Inventory account

B) Manufacturing Overhead account

C) Finished Goods Inventory account

D) Wages Payable account

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the basic flow of inventory through a manufacturing system,which of the following occurs first in a job costing system?

A) Cost of goods sold

B) Finished goods inventory

C) Work in process inventory

D) Raw materials inventory

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

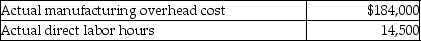

Before the year began,Murphy Manufacturing estimated that manufacturing overhead for the year would be $175,500 and that 13,000 direct labor hours would be worked.Actual results for the year included the following:

The amount of manufacturing overhead allocated for the year based on direct labor hours would have been

The amount of manufacturing overhead allocated for the year based on direct labor hours would have been

A) $179,750.

B) $195,750.

C) $175,500.

D) $184,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following types of costing is used for many similar products?

A) Process costing

B) Batch costing

C) Service costing

D) Job costing

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To allocate manufacturing overhead to specific jobs,the needed journal entry would include a

A) credit to Work-in-Process Inventory account.

B) debit to Manufacturing Overhead account.

C) debit to Cost of Goods Sold account.

D) credit to Manufacturing Overhead account.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The amount of overallocation or underallocation is typically corrected by adjusting Cost of Goods Sold on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nadal Company is debating the use of direct labor cost or direct labor hours as the cost allocation base for allocating manufacturing overhead.The following information is available for the most recent year:

If Nadal Company uses direct labor hours as the allocation base,what would the predetermined manufacturing overhead rate be?

If Nadal Company uses direct labor hours as the allocation base,what would the predetermined manufacturing overhead rate be?

A) $1.51 per direct labor hour

B) $1.40 per direct labor hour

C) $1.60 per direct labor hour

D) $1.72 per direct labor hour

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A production schedule always covers a one-year period of time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Here are selected data for Tyler Corporation:

What is the balance in work in process inventory at the end of the year?

What is the balance in work in process inventory at the end of the year?

A) $30,300

B) $27,700

C) $49,200

D) $23,800

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The amount of overallocation or underallocation is found by taking the difference between the amount of overhead allocated during the year and the amount of overhead estimated for the year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of direct labor used in production is recorded as a

A) debit to Work-in-Process Inventory account.

B) debit to Manufacturing Overhead account.

C) debit to wages expense.

D) debit to wages payable.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 334

Related Exams