A) make annual coupon payments.

B) have fixed coupon payments.

C) have a fixed maturity.

D) all of the above

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Standard & Poor's has for years provided credit ratings on international bonds.

A) The ratings reflect the safety of principal for a U.S.investor.

B) Their ratings reflect the creditworthiness of the borrower and not exchange rate uncertainty.

C) Their ratings reflect creditworthiness of the lender and predict the exchange rate expected to prevail at maturity.

D) The ratings are biased since 40 percent of Eurobond issues are rated AAA and 30 percent are AA.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The four currencies in which the majority of domestic and international bonds are denominated are

A) U.S.dollar, the euro, the Indian rupee, and the Chinese Yuan.

B) U.S.dollar, the euro, the pound sterling, and the Swiss franc.

C) U.S.dollar, the euro, the Swiss franc, and the yen.

D) U.S.dollar, the euro, the pound sterling, and the yen.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zero coupon bonds

A) have no interest income.

B) are sold at a premium to par value.

C) gave only capital gains income.

D) both a) and c)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming that the bond sells at par,the implicit $/£ exchange rate at maturity of a British pound-U.S.dollar dual currency bonds that pay £581.40 at maturity per $1,000 of par value is:

A) $1.95/£1.00

B) $1.72/£1.00

C) $1.58/£1.00

D) $0.5814/£1.00

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"Yankee" bonds are

A) dollar-denominated foreign bonds originally sold to U.S.investors.

B) yen-denominated foreign bonds originally sold in Japan.

C) pound sterling-denominated foreign bonds originally sold in the U.K.

D) none of the above

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Private placement bond issues

A) do not have to meet the strict information disclosure requirements of publicly traded issues.

B) have auditing requirements that do not adhere to publicly traded issues.

C) meet the strict information disclosure requirements of publicly traded issues, but have larger minimum denominations.

D) none of the above

F) C) and D)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

The Eurobond segment of the international bond market

A) is roughly four times the size of the foreign bond segment.

B) has considerably less regulatory hurdles than the foreign bond segment.

C) typically has a lower rate of interest that borrowers pay in comparison to Yankee bond financing.

D) all of the above

F) B) and C)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Publicly traded Yankee bonds must

A) meet the same regulations as U.S.domestic bonds.

B) meet the same regulations as Eurobonds if sold to Europeans.

C) meet the same regulations as Samurai bonds if sold to Japanese.

D) none of the above

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Eurobonds are usually

A) registered bonds.

B) bearer bonds.

C) floating-rate, callable and convertible.

D) denominated in the currency of the country that they are sold in.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Floating-rate notes

A) are a form of adjustable rate bond.

B) have contractually specified coupon payments, therefore they are fixed rate bonds.

C) always trade at par value.

D) both a) and c)

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

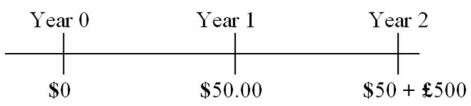

Find the value today of a 2-year dual currency bond with annual coupons (paid in U.S.dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity.The cash flows of the bond are:  The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is $ = 2% in the U.S.and £ = 3% in the U.K.

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is $ = 2% in the U.S.and £ = 3% in the U.K.

A) $927.62

B) $941.30

C) $965.06

D) $599.00

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the bond market,there are brokers and market makers.Which of the following are true?

A) Brokers accept buy or sell orders from market makers and then attempt to find a matching party for the other side of the trade; they may also trade for their own account.

B) Brokers charge a small commission for their services to the market maker that engaged them.

C) Brokers do not deal directly with retail clients.

D) All of the above

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A convertible bond pays interest annually at a coupon rate of 5% on a par value of $1,000.The bond has 10 years maturity remaining and the discount rate on otherwise identical non-convertible debt is 6.5%.The bond is convertible into shares of common stock at a conversion price of $25 per share (i.e.the bond is exchangeable for 40 shares) .Today's closing stock price was $20.What is the floor value of this bond?

A) $800.00

B) $892.17

C) $1,250

D) None of the above

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Six-month U.S.dollar LIBOR is currently 4.375%; your firm issued floating-rate notes indexed to six-month U.S.dollar LIBOR plus 50 basis points.What is the amount of the next semi-annual coupon payment per U.S.$1,000 of face value?

A) $43.75

B) $48.75

C) $24.375

D) $46.875

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A five-year floating-rate note has coupons referenced to six-month dollar LIBOR,and pays coupon interest semiannually.Assume that the current six-month LIBOR is 6 percent.If the risk premium above LIBOR that the issuer must pay is 1/8 percent,the next period's coupon rate on a $1,000 face value FRN will be:

A) $29.375

B) $30.000

C) $30.625

D) $61.250

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With regard to clearing procedures for bond transactions

A) it is a system for transferring ownership of bonds.

B) it is a system for ensuring payment from buyers to sellers.

C) most Eurobond trades clear through two major clearing systems.

D) all of the above

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A "foreign bond" issue is

A) one denominated in a particular currency but sold to investors in national capital markets other than the country that issued the denominating currency.

B) one offered by a foreign borrower to investors in a national market and denominated in that nation's currency.

C) for example, a German MNC issuing dollar-denominated bonds to U.S.investors.

D) both b) and c)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because __________ do not have to meet national security regulations,name recognition of the issuer is an extremely important factor in being able to source funds in the international capital market.

A) Eurobonds

B) Foreign bonds

C) Bearer bonds

D) Registered bonds

F) B) and D)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

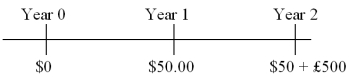

Find the value today of a 2-year dual currency bond with annual coupons (paid in U.S.dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity.The cash flows of the bond are:  The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; the pound-based yield to maturity is i£ = 4%.

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; the pound-based yield to maturity is i£ = 4%.

A) $927.77

B) $941.30

C) $965.06

D) $880.65

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 100

Related Exams