A) Direct materials

B) Sales revenue

C) Direct labor

D) Depreciation on factory equipment

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

Earnst & Earnst Consulting pays Amber Kelly $58,000 per year. The cost of her annual benefits is $17,000. Kelly works 2,500 hours per year. A)What is the hourly rate to Earnst & Earnst Consulting of employing Amber Kelly? B)If Amber works 30 hours for client 252, what is the direct labor cost associated with that client?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead has an underallocated balance of $6,200; raw materials inventory balance is $50,000; work in process inventory is $30,000; finished goods inventory is $20,000; and cost of goods sold is $100,000. Which of these accounts would have an ending credit balance?

A) Raw materials inventory

B) Finished goods inventory

C) Work in process inventory

D) None of the above

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most significant cost for a service company is

A) labor.

B) manufacturing overhead.

C) supplies.

D) indirect costs.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When is the predetermined manufacturing overhead rate computed?

A) During the period

B) Before the period starts

C) At the end of the period

D) Can be done at any time

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Generally Accepted Accounting Principles (GAAP)mandates the type of product costing system (job costing or process costing)that must be used by a manufacturer.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

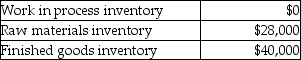

The following account balances at the beginning of January were selected from the general ledger of Ocean City Manufacturing Company:  Additional data:1) Actual manufacturing overhead for January amounted to $62,000.

2) Total direct labor cost for January was $63,000.

3) The predetermined manufacturing overhead rate is based on direct labor cost. The budget for the year called for $250,000 of direct labor cost and $350,000 of manufacturing overhead costs.

4) The only job unfinished on January 31 was Job No. 151, for which total direct labor charges were $5,200 (800 direct labor hours) and total direct material charges were $14,000.

5) Cost of direct materials placed in production during January totaled $123,000. There were no indirect material requisitions during January.

6) January 31 balance in raw materials inventory was $35,000.

"7) Finished goods inventory balance on January 31 was $34,500.

Has manufacturing overhead been overallocated or underallocated and by what amount as of January 31?"

Additional data:1) Actual manufacturing overhead for January amounted to $62,000.

2) Total direct labor cost for January was $63,000.

3) The predetermined manufacturing overhead rate is based on direct labor cost. The budget for the year called for $250,000 of direct labor cost and $350,000 of manufacturing overhead costs.

4) The only job unfinished on January 31 was Job No. 151, for which total direct labor charges were $5,200 (800 direct labor hours) and total direct material charges were $14,000.

5) Cost of direct materials placed in production during January totaled $123,000. There were no indirect material requisitions during January.

6) January 31 balance in raw materials inventory was $35,000.

"7) Finished goods inventory balance on January 31 was $34,500.

Has manufacturing overhead been overallocated or underallocated and by what amount as of January 31?"

A) $26,200 overallocated

B) $26,200 underallocated

C) $17,000 overallocated

D) $17,000 underallocated

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

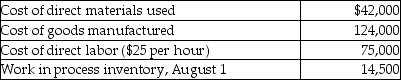

Maple Company uses a job costing system. Maple Company's schedule of cost of goods manufactured showed the following amounts for the month ended August 31.  Manufacturing overhead cost is allocated at the rate of $13 per direct labor hour.

What is the amount of allocated manufacturing overhead costs for August?

Manufacturing overhead cost is allocated at the rate of $13 per direct labor hour.

What is the amount of allocated manufacturing overhead costs for August?

A) $42,000

B) $75,000

C) $124,000

D) $39,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

London Ceramics makes custom ceramic tiles. During March, the company started and finished Job #266. Job #266 consists of 2,500 tiles; each tile sells for $12.00. The company's records show the following direct materials were requisitioned for Job #266. Basic terra cotta tiles: 2,500 units at $4.00 per unit Specialty paint: 5 quarts at $7.00 per quart High gloss glaze: 4 quarts at $12.00 per quart Labor time records show the following employees worked on Job #266: Alice Cooper: 18 hours at $24 per hour Matthew Kline: 20 hours at $13 per hour Sierra Ceramics allocates manufacturing overhead at a rate of $27 per direct labor hour. What is the gross profit per tile on Job #266?

A) $12.00

B) $7.28

C) $7.69

D) $11.59

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

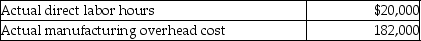

Before the year began, Plastics Manufacturing estimated that manufacturing overhead for the year would be $150,000 and that 25,000 direct labor hours would be worked. Actual results for the year included the following:  If the company allocates manufacturing overhead based on direct labor hours, the manufacturing overhead for the year would have been

If the company allocates manufacturing overhead based on direct labor hours, the manufacturing overhead for the year would have been

A) $62,000 overallocated.

B) $62,000 underallocated.

C) $32,000 overallocated.

D) $32,000 underallocated.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Squire Corporation charged Job 110 with $13,400 of direct materials and $11,900 of direct labor. Allocation for manufacturing overhead is 75% of direct labor costs. What is the total cost of Job 110?

A) $34,225

B) $ 8,925

C) $41,167

D) $25,300

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

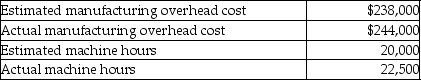

Poland's Paints allocates overhead based on machine hours. Selected data for the most recent year follow.  The estimates were made as of the beginning of the year, while the actual results were for the entire year.

The amount of manufacturing overhead allocated for the year based on machine hours would have been

The estimates were made as of the beginning of the year, while the actual results were for the entire year.

The amount of manufacturing overhead allocated for the year based on machine hours would have been

A) $244,000.

B) $238,000.

C) $267,750.

D) $241,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

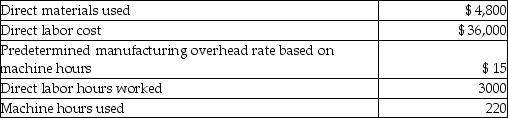

Nadal Corporation manufactures custom molds for use in the extrusion industry. The company allocates manufacturing overhead based on machine hours. Selected data for costs incurred for Job 532 are as follows:  What is the manufacturing cost of Job 532?

What is the manufacturing cost of Job 532?

A) $3,300

B) $40,800

C) $85,800

D) $44,100

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Job 222 started on June 1 and finished on July 15. Total cost on July 1 was $12,400, and the costs added in July were $188,500. The entry for the sale at a price of $310,000 would be:

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 321 - 334 of 334

Related Exams