A) $4,057.50

B) $6,426

C) $10,483.50

D) $14,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One advantage of a lump-sum tax over other taxes is that it

A) is both equitable and efficient.

B) doesn't cause deadweight loss.

C) would place a larger tax burden on the rich.

D) would raise more revenues.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A person's tax liability refers to

A) the percentage of income that a person much pay in taxes.

B) the amount of tax a person owes to the government.

C) the amount of tax the government is required to refund each person.

D) deductions that can be legally subtracted from a person's income each year.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The government finances the budget deficit by

A) borrowing from the public.

B) borrowing solely from the Federal Reserve Bank.

C) printing currency in the amount of the budget deficit.

D) requiring that budget surpluses occur every other year to pay off the deficits.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If all taxpayers pay the same percentage of income in taxes,the tax system is progressive.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Suppose Jim and Joan receive great satisfaction from their consumption of cheesecake. Joan would be willing to purchase only one slice and would pay up to $6 for it. Jim would be willing to pay $9 for his first slice, $7 for his second slice, and $3 for his third slice. The current market price is $3 per slice. -Refer to Scenario 12-1.Assume that the government places a $4 tax on each slice of cheesecake and that the new equilibrium price is $7.Which of the following statements is correct?

A) Jim will bear the full burden of the deadweight loss.

B) Joan will bear the full burden of the deadweight loss.

C) Both Joan and Jim will share the burden of the deadweight loss.

D) There will be no deadweight loss.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A budget surplus occurs when government receipts fall short of government spending.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Social Security is an income support program,designed primarily to maintain the living standards of the poor.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A person's tax obligation divided by her income is called her

A) marginal social tax rate.

B) marginal private tax rate.

C) marginal tax rate.

D) average tax rate.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

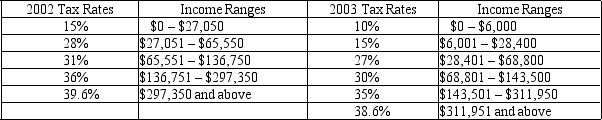

Table 12-2

United States Income Tax Rates for a Single Individual, 2002 and 2003.

-Refer to Table 12-2.Costa is a single person whose taxable income is $50,000 a year.What is his marginal tax rate in 2002?

-Refer to Table 12-2.Costa is a single person whose taxable income is $50,000 a year.What is his marginal tax rate in 2002?

A) 15%

B) 28%

C) 31%

D) 36%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If Christopher earns $80,000 in taxable income and pays $20,000 in taxes,his average tax rate is 20 percent.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

An income tax in which the average tax rate is the same for all taxpayers would be considered a

A) progressive tax.

B) regressive tax.

C) distortion-free tax.

D) proportional tax.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is justified on the basis that taxpayers receive specific government services,the tax

A) is considered horizontally equitable.

B) burden is minimized.

C) satisfies the benefits principle.

D) is considered vertically equitable.

F) A) and D)

Correct Answer

verified

C

Correct Answer

verified

True/False

Antipoverty programs funded by taxes on the wealthy are sometimes advocated on the basis of the benefits principle.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are trying to design a tax system that will simultaneously achieve both of the following goals: 1) two people with the same total income would pay taxes of the same amount,and 2) a high-income person would pay a higher fraction of income in taxes than a low-income person.Which of the following tax systems could achieve both goals?

A) a lump-sum tax

B) a regressive tax

C) a progressive tax

D) a proportional tax

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the marginal tax rate exceeds the average tax rate,the tax is

A) proportional.

B) regressive.

C) non-egalitarian.

D) progressive.

F) A) and B)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

If revenue from a gasoline tax is used to build and maintain public roads,the gasoline tax may be justified on the basis of

A) the benefits principle.

B) the ability-to-pay principle.

C) vertical equity.

D) horizontal equity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corporate profits are

A) included in payroll taxes.

B) exempt from taxes.

C) taxed twice, once as profit and once as dividends.

D) taxed to pay for Medicare.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2004,social insurance taxes represented what percentage of total receipts for the federal government?

A) 50

B) 39

C) 20

D) 8

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The tax that generates the most revenue for state and local government is the

A) corporate income tax.

B) individual income tax.

C) property tax.

D) sales tax.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 328

Related Exams