B) False

Correct Answer

verified

Correct Answer

verified

True/False

LLC members have more flexibility than corporate shareholders to alter their legal arrangements with respect to one another, the entity, and with outsiders.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Shareholders of C corporations receiving property distributions must recognize dividend income equal to the fair market value of the distributed property if the distributing corporation has sufficient earnings and profits.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Crocker and Company (CC) is a C corporation. For the year, CC reported taxable income of $564,500. At the end of the year, CC distributed all its after-tax earnings to Jimmy, the company's sole shareholder. Jimmy's marginal ordinary tax rate is 37 percent and his marginal tax rate on dividends is 23.8 percent, including the net investment income tax. What is the overall tax rate on Crocker and Company's pretax income?

A) 18.8%.

B) 23.8%.

C) 21%.

D) 39.8%.

E) 44.8%.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which legal entity is correctly paired with the party that bears the ultimate responsibility for paying the legal entity's liabilities?

A) LLC - LLC members.

B) Corporation - Shareholders..

C) General partnership - Partnership.

D) Limited partnership - General partner.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From a tax perspective, which entity choice is preferred when a liquidating distribution occurs and the entity has assets that have declined in value?

A) General partnership.

B) S corporation.

C) Limited partnership

D) All of the above receive the same tax treatment on liquidating distributions.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

C corporations and S corporations are separate taxpaying entities that pay tax on their own income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Business income allocations to owners from an LLC that is taxed as a partnership are subject to self-employment tax if the owners are significantly involved in the entity's business activities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

S corporation shareholders are subject to self-employment tax on business income allocations from the S corporation if they are actively involved in the S corporation's business.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Roberto and Reagan are both 25-percent owner/managers for Bright Light Incorporated. Roberto runs the retail store in Sacramento, California, and Reagan runs the retail store in San Francisco, California. Bright Light Incorporated generated a $125,000 profit companywide made up of a $75,000 profit from the Sacramento store, a ($25,000) loss from the San Francisco store, and a combined $75,000 profit from the remaining stores. If Bright Light Incorporated is an S corporation, how much income will be allocated to Roberto?

A) $31,250

B) $62,500

C) $75,000

D) $125,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What kind of deduction is the deduction for qualified business income?

A) A for AGI deduction.

B) A from AGI deduction that is not an itemized deduction.

C) A from AGI deduction that is an itemized deduction.

D) None of the choices is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

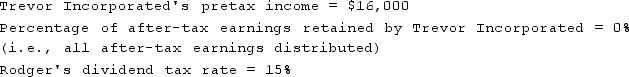

Rodger owns 100 percent of the shares in Trevor Incorporated a C corporation. Assume the following for the current year:

Given these assumptions, how much cash does Rodger have from the dividend after paying taxes on the distribution?

Given these assumptions, how much cash does Rodger have from the dividend after paying taxes on the distribution?

Correct Answer

verified

Correct Answer

verified

Essay

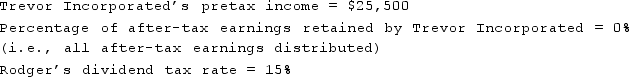

Rodger owns 100percent of the shares in Trevor Incorporated a C corporation. Assume the following for the current year:

Given these assumptions, how much cash does Rodger have from the dividend after paying taxes on the distribution? (Round your intermediate calculations and final answer to whole number dollar amount.)

Given these assumptions, how much cash does Rodger have from the dividend after paying taxes on the distribution? (Round your intermediate calculations and final answer to whole number dollar amount.)

Correct Answer

verified

Correct Answer

verified

True/False

Due to recent tax law changes, C corporations are no longer subject to double taxation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following legal entities are generally classified as C corporations for tax purposes?

A) Limited liability companies.

B) S corporations.

C) Limited partnerships.

D) Sole proprietorships.

E) None of the choices is correct.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Logan, a 50-percent shareholder in Military Gear Incorporated (MG) , is comparing the tax consequences of losses from C corporations with losses from S corporations. Assume MG has a $108,000 tax loss for the year, Logan's tax basis in his MG stock was $154,000 at the beginning of the year, and he received $79,000 ordinary income from other sources during the year. Assuming Logan's marginal tax rate is 24 percent, how much more tax will Logan pay currently if MG is a C corporation compared to the tax he would pay if it were an S corporation?

A) $0

B) 6,000

C) 12,960

D) 18,960

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true for entity owners who pay the self-employment tax and the additional Medicare tax?

A) Both the self-employment tax and the additional Medicare tax are deductible for AGI in full.

B) Half of the self-employment tax and half of the additional Medicare tax are deductible for AGI.

C) Half of the self-employment tax and none of the additional Medicare tax are deductible for AGI.

D) None of the self-employment tax and none of the additional Medicare tax are deductible for AGI.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Unincorporated entities with only one individual owner are taxed as sole proprietorships.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Stacy would like to organize SST (a business entity)as either an LLC (taxed as a partnership)or as a corporation (taxed as a C corporation)generating a 10 percent annual before-tax return on a $600,000 investment. Stacy's marginal tax rate on ordinary income is 37 percent. Stacy's marginal tax rate on individual capital gains and dividends is 23.8 percent, including the net investment income tax. SST will pay out its after-tax earnings every year to either its members or its shareholders. If SST is taxed as a partnership, Stacy would be subject to a 2.9 percent self-employment tax rate and a .9 percent additional Medicare tax. Assume that SST's income is not qualified business income for purposes of the qualified business income deduction. How much would Stacy have after taxes if SST is organized as either an LLC or a C corporation?

Correct Answer

verified

Correct Answer

verified

True/False

If a C corporation incurs a net operating loss in 2020 and carries the loss forward to 2021, the NOL carryover is not allowed to offset 100 percent of the corporation's taxable income (before the net operating loss deduction).

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 87

Related Exams