A) ($53,000) .

B) ($3,000) .

C) ($56,000) .

D) $0; this is an operating activity.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Depreciation Expense is $20,000 and the beginning and ending Accumulated Depreciation balances are $150,000 and $155,000, respectively. What is the cash paid for depreciation?

A) $20,000

B) $5,000

C) $0

D) $25,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a company generally records revenues and expenses before receiving or making cash payments. Which of the following statements is not correct?

A) If revenues are falling, a net loss could result even though the company reports a net cash inflow from operating activities.

B) If revenues are rising, net income could result even though the company reports a net cash outflow from operating activities.

C) Net income and net cash flows provided by operating activities will always agree.

D) The income statement doesn't explain changes in cash because it focuses on just the operating results of the business.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be classified as a financing activity on the statement of cash flows?

A) Cash receipts from accounts receivable collections

B) Cash receipts from sale of equipment

C) Cash paid to purchase treasury stock

D) Cash paid for interest on notes payable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following represent cash outflows from financing activities?

A) Distributing a stock dividend

B) Paying a bond's face value at maturity

C) Issuing long-term bonds at a discount

D) Paying interest on promissory notes

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Company X paid Company Y $1.35 million for a new plant. During the same accounting period, Company X experienced the following changes in its balance sheet: Cash decreased by $350,000, Accounts Receivable increased by $321,300, Inventory increased by $275,800, Property, Plant, and Equipment increased by $752,900, and Bonds Payable increased by $1 million. The net cash flow provided by financing activities is:

A) An inflow of $1.35 million.

B) An outflow of $350,000.

C) An inflow of $1 million.

D) An inflow of $752,900.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

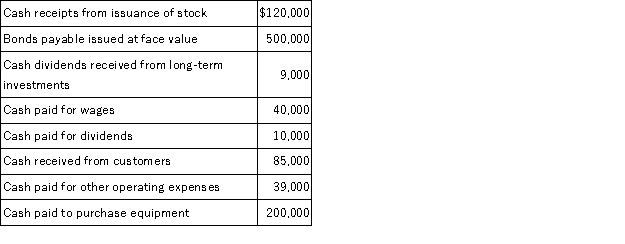

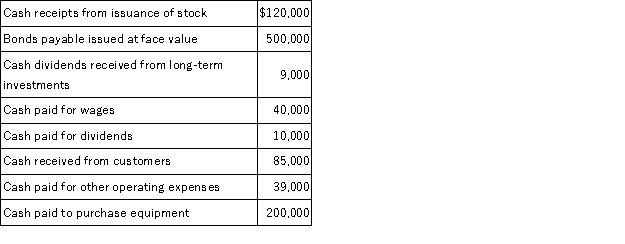

Flynn Corporation had the following cash flows for the current year. The company uses the direct method in preparing the statement of cash flows.  What is the net cash flows provided by (used in) financing activities?

What is the net cash flows provided by (used in) financing activities?

A) $620,000

B) $410,000

C) $610,000

D) $490,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the indirect method is used, details from which of the following balance sheet accounts are used in calculating both operating and financing cash flows?

A) Bonds Payable

B) Taxes Payable

C) Retained Earnings

D) Common Stock

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

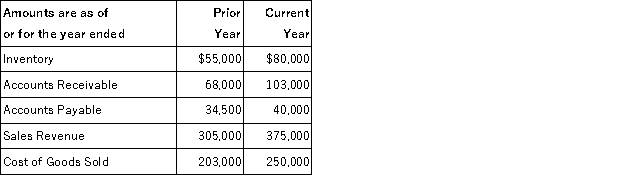

St. Pierre Enterprises reported the following information in its financial statements:  What is the amount of cash payments made to suppliers during the current year?

What is the amount of cash payments made to suppliers during the current year?

A) $280,500

B) $269,500

C) $394,500

D) $230,500

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about classification choices is correct?

A) GAAP classifies cash dividends paid as a financing activity, but IFRS allows them to be classified as either an operating or financing activity.

B) GAAP allows interest paid to be classified as either an operating or financing activity, but IFRS requires that it be classified as a financing activity.

C) GAAP classifies cash dividends received as an investing activity, but IFRS allows them to be classified as either an operating or investing activity.

D) GAAP classifies interest received as either an operating or investing activity, but IFRS requires it to be classified as an investing activity.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In determining cash flows related to investing activities, which accounts are analyzed?

A) Inventory and accounts receivable.

B) Loans payable and common stock.

C) Short-term investments and prepaid expenses.

D) Long-lived tangible and intangible assets.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The statement of cash flows may be viewed in terms of the balance sheet equation. Which of the following expressions below is correct?

A) Change in Cash = Change in (Liabilities + Stockholders' Equity - Noncash Assets)

B) Change in Cash = Change in (Stockholders' Equity - Liabilities + Noncash Assets)

C) Change in Cash = Change in (Liabilities - Noncash Assets)

D) Change in Cash = Change in (Stockholders' Equity - Liabilities)

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In calculating the net cash provided by or used in operations using the indirect method, which of the following items would be subtracted from net income?

A) A decrease in Prepaid Rent

B) An increase in Accounts Receivable

C) An increase in long-lived assets

D) An increase in Salaries and Wages Payable

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In the decline phase, the company continues to enjoy positive operating cash flows but stops spending cash on investing activities and instead uses its cash for financing activities such as repaying lenders and returning excess cash to shareholders

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has a net cash inflow from operating activities of $789,000, a net cash outflow of $50,000 from investing activities and a net cash inflow of $100,000 from financing activities. The company paid $124,000 in interest, $186,500 in income taxes, and $200,000 in cash dividends. Which of the following statements about the statement of cash flows is not correct?

A) The cash dividends of $200,000 paid will be reported as a cash outflow in the cash flow from investing activities section.

B) Supplemental disclosures required for a company using the indirect method include the amount of interest and the amount of income taxes paid.

C) The statement of cash flows will show a net increase in cash and cash equivalents of $839,000.

D) If the direct method is used, the $124,000 of interest paid and the $186,500 of income taxes paid will be reported in the cash flows from operating activities.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Allison Co. uses the direct method to determine its cash flow from operations. During the year, it had sales revenue of $300,000. Its beginning Accounts Receivable balance was $30,000, and its ending Accounts Receivable balance was $40,000. Its cash collected from customers for the year was:

A) $300,000.

B) $290,000.

C) $310,000.

D) $370,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flynn Corporation had the following cash flows for the current year. The company uses the direct method in preparing the statement of cash flows.  If the cash balance at the beginning of the current year was $0, what is the amount of cash at the end of the year?

If the cash balance at the beginning of the current year was $0, what is the amount of cash at the end of the year?

A) $112,500

B) $425,000

C) $737,500

D) $311,500

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the direct method is used to prepare the operating activities section of the statement of cash flows. Which of the following statements is correct concerning a decrease in Accounts Payable?

A) Since the cash payments were more than the credit purchases, the decrease must be added to purchases to calculate cash payments to suppliers.

B) Since the cash payments were less than credit purchases, the decrease must be added to purchases to calculate cash payments to suppliers.

C) Since the cash payments were more than credit purchases, the decrease must be subtracted from purchases to cash payments to suppliers.

D) Since the cash payments were less than credit purchases, the decrease must be subtracted from purchases to calculate cash payments to suppliers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flows from operating activities include:

A) changes in accounts receivable

B) paying principal to lenders

C) purchases of equipment

D) proceeds from stock issuance

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Accrual-based net income can be manipulated because it is based on estimates.

B) Cash flows are easily manipulated because they are based on estimates.

C) Accrual-based net income is not easily manipulated because valuation for such items as bad debts and inventory are precise and based on objectively verifiable information.

D) Cash flows are not easily manipulated because they are generated by internal transactions and do not involve external parties.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 208

Related Exams