B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

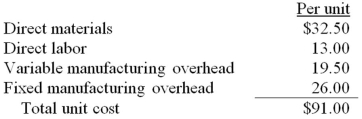

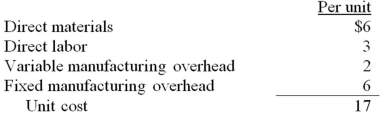

Cotton Corp currently makes 10,000 subcomponents a year in one of its factories.The unit costs to produce are: An outside supplier has offered to provide Cotton Corp with the 10,000 subcomponents at a $84.50 per unit price.Fixed overhead is not avoidable.If Cotton Corp rejects the outside offer,what will be the effect on short-term profits?

A) $260,000 increase

B) $195,000 decrease

C) no change

D) $65,000 increase

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

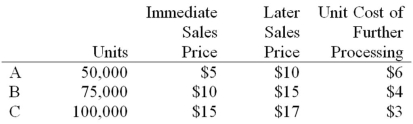

Dardon Company currently produces three products from a joint process.The joint process has total costs of $250,000 per month.All three products,A,B & C,are immediately saleable as they come out of the joint process.Alternatively,any of the products could continue on with additional processing and be sold as a more complete product.The following information is available: Which of the products should be sold immediately without further processing?

A) Product A only

B) Products B and C

C) Products A and C

D) Product B only

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not another term for relevant costs?

A) differential costs

B) incremental costs

C) opportunity costs

D) avoidable costs

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

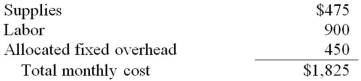

Moss,Inc.currently processes payroll in its accounting department,which costs the following per month: Moss could use a payroll processing firm instead,which would cost $1,350 per month,but the firm would provide all supplies.If Moss used the outside firm,the accountants who currently process payroll would be reassigned to other accounting tasks.How much would monthly costs be affected if Moss switched to the payroll processing firm?

A) Increase $875

B) Decrease $475

C) Increase $225

D) Decrease $225

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true of a firm that has reached the limit on its resources?

A) It has idle capacity

B) Opportunity costs are now relevant

C) It has no relevant costs

D) It has excess capacity

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following types of decisions involves deciding whether to perform a particular activity in-house or purchase it from an outside supplier?

A) Special-order

B) Make-or-buy

C) Continue or discontinue

D) Sell-or-process further

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

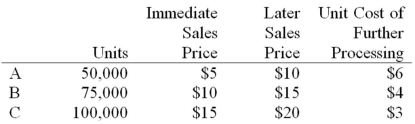

Dundee Company currently produces three products from a joint process.The joint process has total costs of $250,000 per month.All three products,A,B & C,are immediately saleable as they come out of the joint process.Alternatively,any of the products could continue on with additional processing and be sold as a more complete product.The following information is available: Which of the products should be sold after further processing?

A) Product A only

B) Products B and C

C) Products A and C

D) Product B only

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

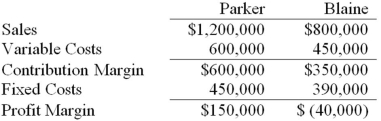

Hamilton,Inc.has two divisions,Parker and Blaine.Following is the income statement for the previous year: Of the total fixed costs,$600,000 are common fixed costs that are allocated equally between the divisions.What is Parker's segment margin?

A) $150,000

B) $450,000

C) $600,000

D) $1,200,000

F) All of the above

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Henry Sweet currently makes 6" candy sticks that it sells for $.20 each.Henry can make 12" candy sticks out of two 6" candy sticks by melting them together,which costs an additional $.03 per 12" stick.Henry can sell the 12" sticks for $.45.Henry has enough capacity to make 10,000 6" candy sticks per month,and enough demand to sell all the candy sticks it can manufacture,whether 6" or 12".Should Henry sell 6" or 12" candy sticks,and how much additional profit will their decision bring in per month?

A) Sell 6" sticks,additional $100

B) Sell 6" sticks,additional $250

C) Sell 12" sticks,additional $100

D) Sell 12" sticks,additional $250

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

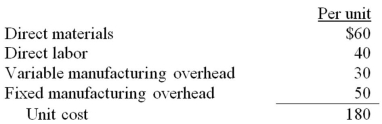

Dot has received a special order for 2,000 units of its product at a special price.The product normally sells for $200 and has the following manufacturing costs: Assume that Dot has sufficient capacity to fill the order without harming normal production and sales.What minimum price should Dot charge to achieve a $50,000 incremental profit?

A) $225

B) $155

C) $168

D) $180

F) A) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

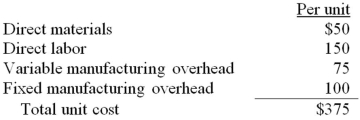

Manor,Inc.currently manufactures 1,000 subcomponents per month in one of its factories.The unit costs to produce the subcomponents are: The unit costs to produce are:

Manor is considering purchasing the subcomponents from an outside supplier,who normally charges $300 per unit.The supplier also has an "Exclusive Buyer's Club" which costs $30,000 per month to join,but whose members can purchase the subcomponents for $250 per unit.Fixed overhead is not avoidable.How many units would Manor need to order per month to make it worth it to join the "Exclusive Buyer's Club"?

A) 800

B) 1,000

C) 1,200

D) 1,500

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What are the decision alternatives in a special-order decision?

A) To make or buy the product.

B) To continue or discontinue the product.

C) To accept or reject the offer.

D) To sell-or-process further.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

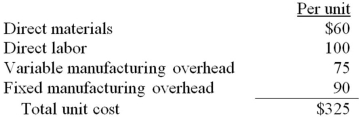

Chafford,Inc.currently manufactures 2,000 subcomponents in one of its factories.The unit costs to produce the subcomponents are: The unit costs to produce are:

Due to a labor strike,Chafford is considering purchasing the subcomponents from an outside supplier for $250 per unit.The union is demanding a 20% increase in pay for direct labor.Fixed overhead is not avoidable.How much could Chafford increase their pay before it would be more advantageous to purchase the subcomponents from the outside supplier?

A) 5%

B) 15%

C) 50%

D) 75%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A product should be processed further if no additional fixed costs are incurred in its processing.If the increased revenue from processing further is enough to offset the incremental cost,the product should be processed further.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Peach has received a special order for 10,000 units of its product.The product normally sells for $20 and has the following manufacturing costs: Assume that Peach has sufficient capacity to fill the order.What price should Peach charge to make a $10,000 incremental profit?

A) $20

B) $17

C) $12

D) $15

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the term for the most constrained resource?

A) The contribution margin.

B) The constrainment.

C) The opportunity cost.

D) The bottleneck.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following types of decisions involves deciding whether to accept or reject an order that is outside the scope of normal sales?

A) Special-order

B) Make-or-buy

C) Continue or discontinue

D) Sell-or-process further

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not relevant to a sell-or-process further decision?

A) The cost of processing the product "as is"

B) The cost of processing the product further

C) The opportunity cost of spending resources processing the product further

D) The incremental revenue from processing the product further

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The foregone benefit of choosing one alternative over another is measured by

A) opportunity costs.

B) activity-based costs.

C) differential costs.

D) capital costs.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 91

Related Exams